Metro Manila Head Office

Address: 12F Sagittarius Building,

111, H.V. Dela Costa Street Salcedo Village, Makati City 1227

Tel: +63 (02) 8540-9623

Email: info@tripleiconsulting.com

The Philippines is situated along a well-defined belt of volcanoes called the Circum-Pacific Rim of Fire where the process of volcanism and plate convergence resulted in the formation of abundant and important metallic mineral deposits of gold, copper, iron, chromite, nickel, cobalt and platinum.

The Philippines considered as one of the countries most endowed with metallic resources in the world, ranks in the top 6 for gold, nickel, copper and chromite and has the potential to be top 10 largest mining power in the world.

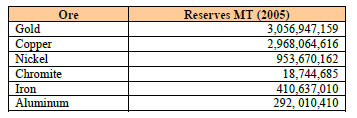

Common metallic minerals extracted in the Philippines:

![]()

Market Opportunities

- 2008 total exports of minerals & mineral products: $2,482 million

- Export destination countries: HongKong, China, Australia, Japan and other trading partners in Asia, North America and Europe

- Concentrate off-take negotiations

Philippine Advantage

Natural Resources

- 9 million hectares are high potential sites for copper, gold, nickel and chromite

- Only 1.4% covered by mining permits

- Ore reserves:

- Philippine offshore area, including the Exclusive Economic Zone (EEZ), covers about 2.2 million sq. km- Potentially rich in place minerals including gold, chromite, magnetite, silica

– New sites discovered with potentially world-class deposits

– Tampakan (copper) – Far Southeast (copper-gold)

– Boyangan (copper)

Technology

- The Philippines has along history and experience in mining.

- High Pressure Acid Leaching (HPAL) – it involves the dissolution of the ores in strong acid under pressures and temperatures to liberate the nickel and other metals in solution to finally produce an intermediate nickel product to be further refined

Support industries and infrastructures

- total sea ports: 2,451 (1,607 public ports, 423 private ports and 412 fishing ports)

- total airports: 89 (10 international airports, 34 domestic airports, 41 community airports, 4 unclassified domestic airports)

- the National Power Corp. and several independent private power generating companies service the power needs of the country

Ideal locations

• most prolific copper and gold producers are found in the Baguio and Mankayan districts

• the Surigao-Davao districts also contribute much to Philippine gold production

• nickel major producers are in Palawan and Surigao

• potential areas and deposits identified by the Mines and Geosciences Bureau:

1.Luzon Central Cordillera – Au, Cu, Fe, Mn

2.Northern Sierra Madre – Cr, Ni, Cu

3.Zambales – Cr, Ni, Co, Pt, Cu, Au

4.Vizcaya-Aurora – Cu, Au

5.Bicol – Au, Fe, Cu

6.Southern Tagalog – Cu, Au, Ni, Co

7.Central Visayas – Cu, Au, Mn

8.Samar- Eastern Mindanao – Au, Cu, Fe, Cr, Ni, Pt, Mn

9.North Central Mindanao – Cr, Cu, Au

10.Zamboanga Peninsula – Au, Cu, Cr, Fe

11.Southern Mindanao – Cu, Au

12.Palawan – Cr, Ni, Co, Pt, Au

Locations of Priority under the Revitalization Program (Operating and Advanced Exploration Stages)

Human resources

• abundant labor force that is highly educated, English proficient and has strong and good work ethics

• a number of mining engineering and geology professionals available in the country

• considerable number of graduates in mining, geological and metallurgical engineering every year

• available laborers with extensive experience in mining related jobs

• presence of professional organizations accredited by the Professional Regulations Commission:

-the Philippine Society of Mining Engineers (PSEM)

-Geological Society of the Philippines (GSP)

-Society of Metallurgical Engineers of the Philippines (SMEP)

Industry Potentials

• increasing contribution to GNP

• increasing contribution to total exports growing number of employed workers

• contributing to the financial coffers of the government through taxes, fees and royalties

• collectively, these projects have invested (from 2004 to 2008) around US$ 1.85 billion; our projections yields a modest investment total of around US$13 billion up to 2013.

Industry Outlook

Outlook for 20012 and 2013 still good in spite of the global economic crisis because:

-demand for gold, copper, iron ore, chromite and coal remain strong

-investors from Korea, Japan, Australia and China are still coming looking for joint venture projects

-banks are liquid and project proponents are upbeat in accessing from them their financial requirements

-several projects are being pushed into operation although some are being re-scheduled

-there is interest from PHILEXIM to provide sovereign and credit guarantee to mining projects

-commodity prices still above their last 5 year averages

Government Support

• the revitalization of the Philippine minerals industry is one of the primary focus are of the President

• since 2004, the Philippine government has been supporting and promoting round sixty mineral development, mineral processing and exploration projects.

Incentives

• In a Financial or Technical Assistance Agreement (FTAA), contractors are entitle to the recovery of the capital investments for a period of five years

• During this period, national taxes are waived but local government taxes are payable. After the recovery period, the benefits are shared 50%/50% based on the net mining revenue, inclusive of taxes;

• Investors can also avail of the incentives under the Special Economic Zone Act of 1994 if they will engage in downstream processing and be entitled to exemptions from certain national and local taxes.

Under the Mining Act

• Income tax carry forward of losses

• Income tax accelerated depreciation of fixed assets

• Exemption from payment of real property taxes on pollution control devices

• Investment guarantees, repatriation of capital, freedom of expropriation, remittance of earnings and interest on foreign loans, freedom from requisition of properties and the confidentiality of information with regards to endeavors and transactions.

Under the Omnibus Investment Code

• Income tax holiday

• Modified duty rate for capital equipment and spare parts

• Exemption from wharfage dues and export tax, duty, impost and fees

• Tax credit on raw materials and supplies

• Additional deduction for labor expense (ADLE)

• Additional deduction for major infrastructure works

Non-fiscal incentives

• Mineral Agreements and Fiscal Regime

• Major types of mining tenements:

Exploration Permit (EP) – 2 years/renewable up to 8 years

-Grants exclusive right to explore and eventually enter into Mineral Agreement of Financial or Technical Assistance Agreement

Mineral Agreement (MA) – 25 years/renewable for 25 years

-Three (3) modes: Mineral Production Sharing; Co-Production and Joint Venture

-Grants exclusive rights to explore, develop and utilize minerals

Financial or Technical Assistant Agreement (FTAA) – 25 years/renewable for 25 years

-Involves large-scale mining operations with minimum committed investment of $50 Million for infrastructure and development

-Needs approval by the President of the Republic of the Philippines

Mineral Processing Permit (MPP) – 5 years/renewable up to 25 years

-Issued for mineral processing operations

100% foreign participation is allowed under EP, FTAA and MPP except for MA which requires at least 60% Filipino ownership

Fiscal Regime Under FTAA

• Allows recovery of Pre-Operating Expenses

-set at a maximum of five (5) years

-may be extended for projects incurring very large investments with high production rate and extensive mine life

• 50% – 50% sharing of the net mining revenue (after recovery of pre-operating expenses)

• Basic Government Share – all taxes, duties, royalties and fees

-national taxes, i.e., Excise Tax, Income Tax, Customs Duties and fees, etc.

-local taxes, i.e., Business Tax, Real Property Tax, etc.,

-payment to Filipinos, i.e., Special Allowance, Royalty to IPs

• Additional Government Share – amount collected to achieve the 50% of the Net Mining Revenue

Existing Players

![]()

Mining Companies with Large Foreign Equity

1.Benguet Corporation – 40% American

2.Eldore Mining Corporation – 40% Australian

3.Gold Fields Philippines Corporation – 40% Australian

4.Philippine Gold Processing & Refining Corporation – 99.99% British

5.TVI Resource Development Philippines, Inc. – 40% HongKong

6.Carrascal Nickel Corporation – 40% Chinese

7.Coral Bay Nickel Corporation – 100% Japanese

8.Platinum Group Metals Corporation – 85.72% Malaysian

9.Rio Tuba Nickel Mining Corp. – 40% Japanese

10.Oriental Synergy Mining Corp. – 31.3% Chinese

Cost of Doing Business

Filing/Renewal Fee of Mining Permits (Based on DAO 2005-08)

a.Application for EP and MA – P 60.00/ha

b.Application for TEP, SMP, SEP, GSQP or GDP – P 20.oo/ha

c.Application for FTAA – P 60.00/ha

Clearance Fee – P 5,000.00/application

Registration Fee

a.For EP, TEP, SMP, SEP, GSQP or GDP – P 5,000.00/permit

b.For MA – 20,000.00/contract

c.For FTAA – 50,000.00/contract

Occupation Fee (for EP, MA, FTAA, TEP, SMP, MLC)

a.Formineral reservation areas – P 100.00/ha

b.For non-mineral reservation areas – P 75.00/ha

Evaluation of Feasibility Study Report/ Environmental Protection and Enhancement Program (EPEP) – P 20,000.00/study report/EPEP

Application for Certificate of Environmental Management and Community Relations Records – P 5,000.00/application

Application for Small-Scale Mining Permit – P 2,000.00/application (individual); P 5,000.00/application (for a corporation, cooperative, association, or partnership)

Filing for Application of Mineral Processing Permit

a.Projects with investments above P 500 million – P 50,000.00/application

b.Projects with investments of P 250 million to P 500 million – P 20,000.00/application

c.Projects with investments of P 250 million and below– P 10,000.00/application

Application of Environmental Clearance Certificate

-EMB Processing Fee – P 6,000.00

Project Cost

Gold/Silver

![]()

Nickel

![]()

Contact Us For Assistance

First Name (required)

Last Name (required)

Your Email (required)

Phone (Enter Your Phone Number if You'd Like Us to Call You)

Your Message